How Can Veterans Get Financial Help?

Many veterans face financial strain after service, from delays in VA benefits and unexpected medical bills to the challenges of transitioning back to civilian life. It’s important to remember that seeking financial help isn’t charity or a handout—it’s a benefit earned through service.

The good news is that real financial help exists for veterans. These programs were created to honor your service by providing support when it’s needed most. If you’re asking, “Can veterans get financial help?” this guide explains exactly where assistance is available, who qualifies, and how to access it quickly through verified federal, nonprofit, and state resources.

How Can Veterans Get Financial Help?

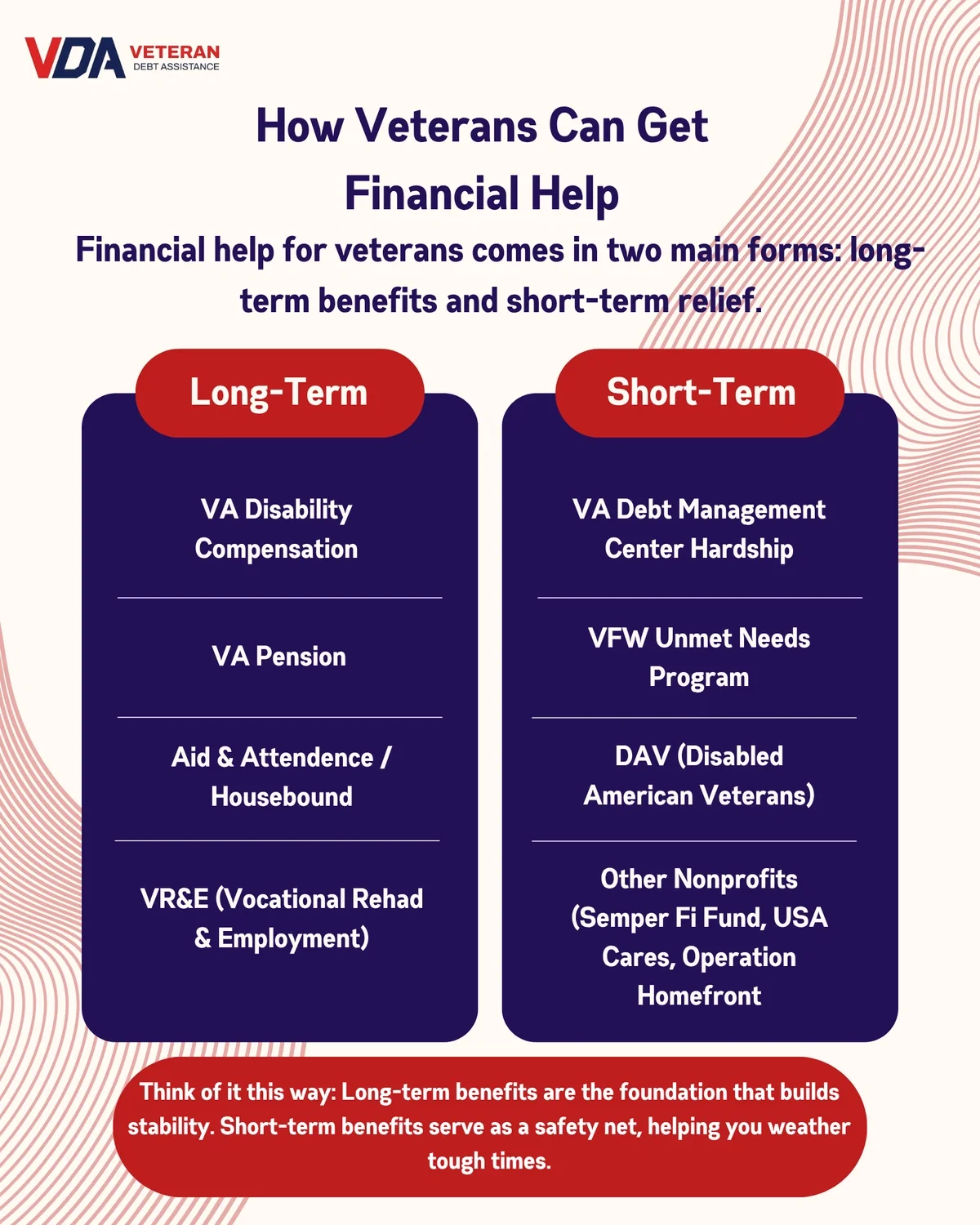

Financial assistance for veterans generally falls into two categories:

Knowing which category fits your situation is key. For instance, if you’re managing chronic challenges (like a service-connected injury or limited income), start with the VA’s long-term benefits.

Conversely, if you’re in immediate crisis, you can lean on hardship relief and nonprofit grants that can bridge the gap while the claims process is underway.

Think of it this way:

- Long-term benefits are your foundation.

- Short-term aid is your safety net.

Federal VA Financial Assistance Programs

The Department of Veterans Affairs is the main hub for consistent, structured financial support. These aren’t “programs you might qualify for someday.” They’re earned benefits designed to help veterans maintain stability after service.

VA Disability Compensation

If you have an illness or injury linked to your service, VA disability compensation provides tax-free monthly payments.

- How it helps: Replaces lost earning capacity, helps pay medical bills, and offsets everyday expenses.

- Who qualifies: Any veteran with a verified service-connected condition, regardless of age or employment status. Conditions can be physical (like joint injuries or hearing loss) or mental health–related (such as PTSD or anxiety disorders).

- How to apply: You can apply at va.gov/disbility by submitting an online application or working with a Veterans Service Officer (VSO) to file your claim. Be sure to have your medical records, service history, and documentation showing how your condition affects your daily life ready to support your application.

VA Pension (Wartime Veterans)

The VA pension for wartime veterans is a needs-based monthly benefit for low-income wartime veterans aged 65 or older, or those permanently disabled. It helps ensure older or disabled veterans maintain a basic standard of living.

- How it helps: The VA Pension supplements limited income and provides a reliable safety net for veterans who no longer have steady earnings. It can be combined with Aid & Attendance or Housebound benefits for additional support.

- Who qualifies: Veterans who either served during an eligible wartime period (as defined by VA), have limited household income and net worth under the VA threshold, or Are age 65+ or permanently disabled.

- How to apply: You can apply at VA.gov/pension. Ensure you have the necessary documentation, such as DD-214, current income and asset records, and medical certification (if disabled).

VA Aid & Attendance / Housebound

These are supplemental monthly payments added to your VA Pension if you require daily assistance or are confined to your home due to disability.

- How it helps: These benefits help cover the cost of personal care attendants, home health aides, or assisted living facilities, expenses that can quickly drain retirement savings.

- Who qualifies: Veterans already receiving a VA Pension, those who need help with activities like bathing, dressing, or feeding, and veterans confined to their homes due to permanent disability.

- How to apply: Complete and submit the VA Form 21-2680 and submit by mailing to your nearest VA Pension Management Center.

Veteran Readiness and Employment (VR&E)

VR&E is a program that provides education, training, and job placement support for veterans with service-connected disabilities, helping them reenter or adapt to the civilian workforce.

- How it helps: VR&E funds certifications, adaptive equipment, and even small business startup assistance for eligible veterans. It’s designed to help you rebuild a sustainable career path, not just find short-term employment.

- Who qualifies: Veterans with at least a 10% service-connected disability rating, those with a demonstrated need for vocational rehabilitation services, and veterans and active-duty members planning their post-service transition.

- How to apply: Visit VA’s VR&E application portal, verify eligibility, complete the VR&E application (VA Form 28-1900), and schedule an appointment with a VA counselor to build your personalized career plan.

Emergency Financial Assistance and Hardship Relief

Even the most disciplined veteran can face unexpected financial challenges, a medical bill that hits between paychecks, a delayed VA payment, or a sudden repair that can’t wait, etc.

That’s where emergency financial assistance programs come in. These resources are designed to help veterans manage immediate crises without sinking into high-interest debt or risking eviction, utility shutoffs, or credit damage.

VA Debt Management Center (DMC) Hardship Options

The VA Debt Management Center assists veterans who owe money to the VA, such as overpayments of disability compensation, education stipends, or medical copays. When finances get tight, you can request a hardship waiver, a compromise offer, or a payment plan to make repayment manageable.

- How it helps: Falling behind on VA debt can impact your benefits, credit score, and peace of mind. The DMC gives veterans breathing room by pausing collections, reducing payments, or forgiving part of the debt when hardship is verified.

- Who qualifies: Any veteran or survivor with an active VA debt balance and applicants who can demonstrate financial hardship (e.g., through loss of income, high medical costs, or essential expenses exceeding income).

- How to apply: Complete VA Form 5655, include documentation of your income, debts, and expenses, submit it online via VA.gov/manage-va-debt/, or mail it to the DMC, and follow up via phone if you don’t hear back within 30 days.

Veterans of Foreign Wars (VFW) Unmet Needs Program

This grant program from the Veterans of Foreign Wars (VFW) provides up to $1,500 in direct financial assistance to veterans, service members, and their families for critical living expenses. Funds are usually paid directly to the creditor or vendor, not the application, and are typically processed within 20 business days.

- How it helps: Unlike loans, these funds do not need to be repaid. They cover immediate necessities such as rent, utilities, vehicle repairs, or food.

- Who qualifies: Active-duty service members, veterans or their immediate family members. All must show financial hardship through supporting documentation and must provide a DD-214 or LES.

- How to apply: Visit the VFW website, complete the online application, and attach proof of hardship (e.g., late notice or repair invoice).

Operation Homefront Critical Financial Assistance

This nonprofit program provides one-time grants ($500–$2,500) to cover essential needs like rent, mortgage, utilities, transportation, and food. Funds are paid directly to service providers, not individuals, ensuring accountability and speed.

- Why it matters: It’s one of the fastest ways for post-9/11 veterans and their families to get relief during financial crises.

- Who qualifies: Post-9/11 veterans and service members.

- How to apply: Visit the Operation Homefront website and submit an online application and required financial documents, such as a DD-214 or LES and income verification.

Nonprofit and Partner Organization Resource

Even with strong VA systems in place, many veterans still experience financial gaps, especially when benefits are delayed or emergencies strike faster than paperwork can move. That’s where nonprofit organizations step in. These groups are often veteran-founded and mission-driven, offering quick, compassionate help that complements federal support.

If you’re wondering how veterans can get financial help outside of the VA, these nonprofit programs are among the most trusted and accessible.

Semper Fi & America’s Fund

This nonprofit provides direct financial grants and ongoing case management to post-9/11 service members, veterans, and their families facing financial or medical hardship.

- How it helps: Their fund is designed for veterans who’ve experienced severe injury, illness, or trauma. Assistance can range from mortgage payments and adaptive housing costs to emergency travel or childcare support.

- Who qualifies: Post-9/11 service members and veterans with verified financial or medical hardship.

- How to apply: Visit thefund.org and complete the necessary assistance request form. Plan to submit documents such as DD-214, income verification, and proof of hardship.

Disabled American Veterans

This is a veteran service organization that offers free benefits assistance, transportation programs, and disaster relief funds for all veterans (not just disabled ones) and their families.

- How it helps: DAV is known for helping veterans access their earned benefits, but it also provides emergency relief after disasters and connects veterans with job resources.

- Who qualifies: Veterans with or without a service-connected disability.

- How to apply: Visit dav.org to locate a local chapter or benefits representative.

Step-by-Step: How to Get Financial Help Fast

When money is tight or when time is critical, knowing how to act can make all the difference. Follow this practical checklist to secure financial help efficiently:

- Assess your situation: List debts, income, and any current or pending VA benefits.

- Prioritize VA resources: Apply for disability, pension, or DMC hardship relief first.

- Contact a Veteran Service Officer (VSO): They’ll help with forms and appeals.

- Apply to at least one nonprofit fund: Choose programs like VFW, USA Cares, or Operation Homefront.

- Document everything: Save letters, emails, and application confirmations.

- Build a zero-based budget: Track where every dollar goes to regain financial control.

FAQ

Q: What’s the best order to apply for financial help as a veteran?

A: Start with VA benefits (like disability or pension), then apply for hardship relief through the DMC, and finally add nonprofit grants for short-term needs.

Q: Can I apply for state or nonprofit aid while waiting for a VA claim decision?

A: Yes. Most state and nonprofit programs accept applicants with pending VA claims. You’ll just need proof that your claim is active or delayed.

Q: What documents should I have ready before applying?

A: Keep a DD-214, recent income or bank statements, proof of hardship (like late notices), and copies of any pending VA correspondence.

Q: How can veterans appeal if their financial help application is denied?

A: You can resubmit with updated documentation or a written hardship statement. Nonprofits and the VA Debt Management Center both allow appeals.

Q: Are National Guard and Reserve members eligible for these programs?

A: Yes. Most federal and nonprofit programs include Guard and Reserve members with qualifying active-duty service and proper documentation.

Q: Does receiving emergency financial help affect my credit score?

A: No. Grants and VA hardship waivers aren’t reported to credit bureaus. They can actually protect your credit by preventing missed payments.